Table of Contents

- Disney Stock

- Printable Disney Stock Certificate Template Cheapest Factory | dgtcom ...

- Disney Shareholders | Who Owns The Most Shares of Disney?

- Is the Disney Stock Sell-Off a Prime Buying Opportunity? | StarTribune ...

- THE WALT DISNEY CO. (DIS) Stock Price Evolution (USD) 1985-2023 # ...

- Should You Buy Walt Disney Co Stock Right Now? 3 Pros, 3 Cons

- Walt Disney Wallpapers Free Stock - Infoupdate.org

- Disney Stock Dives to Multi-Year Low After Earnings Report, Analysts ...

- Iger Told to Sell Disney Park Assets Due to Major Stock Price Dips ...

- Going Into Earnings, Is Disney Stock a Buy? | Morningstar

A Brief History of The Walt Disney Company

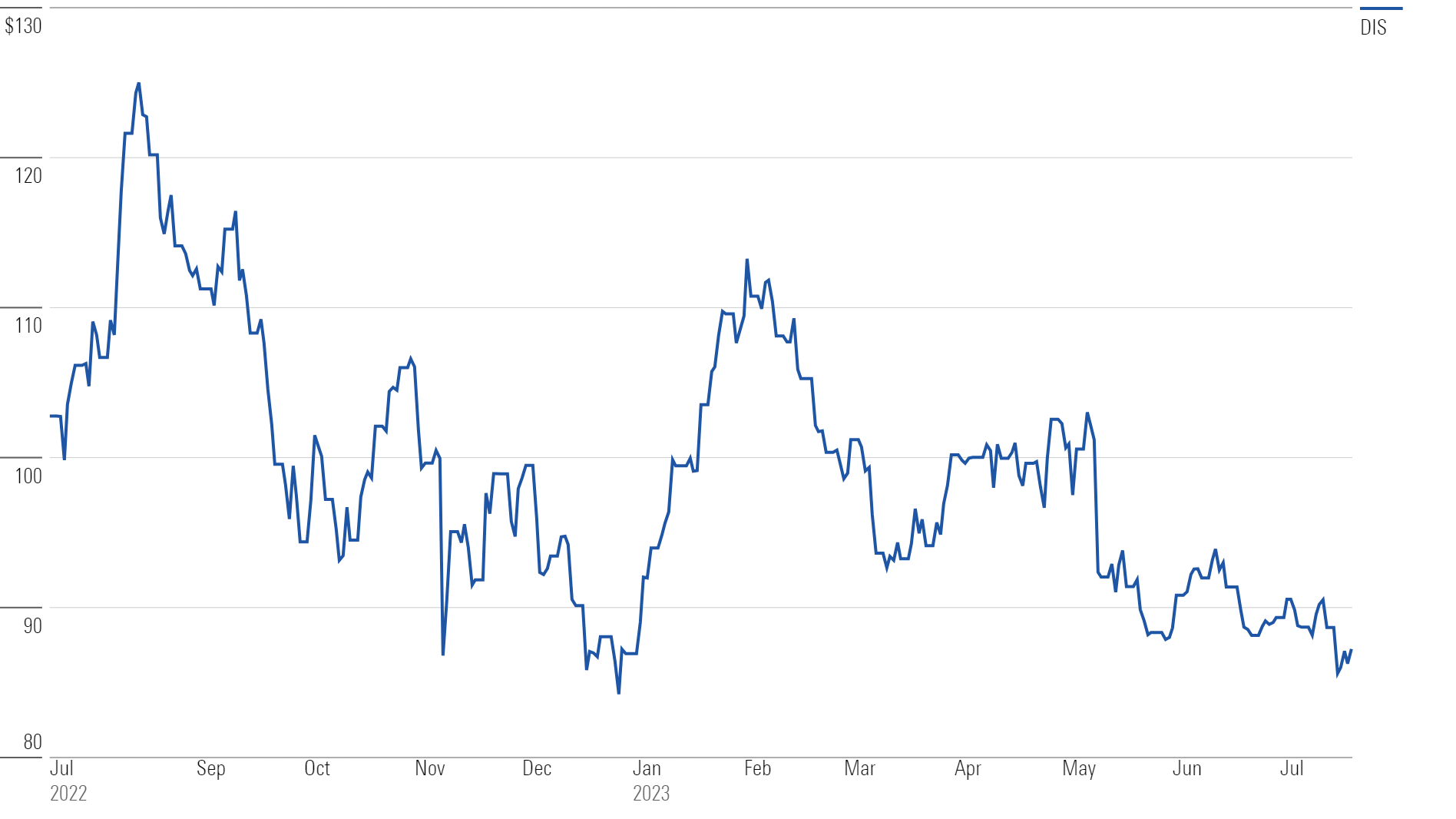

DIS Stock Price and Performance

Despite these challenges, Disney has continued to innovate and expand its offerings, including the launch of its highly successful streaming platform, Disney+. With a growing subscriber base and a vast library of content, Disney+ has become a significant contributor to the company's revenue and growth prospects.

Segments and Growth Drivers

The Walt Disney Company operates through four primary business segments: Media Networks: Including ESPN, ABC, and Disney Channel, this segment generates revenue through advertising, affiliate fees, and content licensing. Parks and Resorts: Comprising theme parks, resorts, and cruise lines, this segment drives revenue through ticket sales, merchandise, and hospitality services. Studio Entertainment: Encompassing film and television production, this segment generates revenue through box office sales, home entertainment, and content licensing. Consumer Products: Including licensing, publishing, and retail, this segment drives revenue through the sale of Disney-branded merchandise and intellectual property. These segments, combined with the company's strategic acquisitions and innovative initiatives, have positioned Disney for long-term growth and success.